How can you be confident that when you look back in 5 years’ time, the CapEx decisions you make today will still look like the right choices? CapEx decisions aren’t only judged by financial stakeholders nowadays – but also against Corporate Social Responsibility (CSR) expectations that draw an emotional and public response.

As our markets fluctuate dynamically, as input costs are increasingly impacted by geo-political events, and as CSR expectations of customers and the public evolve rapidly, how can we ensure that we are creating the optimal assets to optimally meet the challenges of the future?

Through our work with leaders of major capital projects across many sectors, we have identified 3 characteristics of major projects that flag a high risk that the project will not achieve the owner’s desired future outcomes.

1. There’s an imbalance between cost, time and performance criteria.

Around 2010 there was a dramatic increase in the number of oil & gas mega projects, with many focused on large LNG (Liquified Natural Gas) projects. Oil prices had doubled over the previous 5 years, demand was soaring, with the expectation of huge profit margins there was a ‘build it fast any cost’ mentality. The pressure to bring projects on-stream as fast as possible led to a lack of focus on cost. Project costs escalated rapidly, often to over $20bn per facility, as technical challenges were attempted to be solved quickly by throwing money at them, often resulting in over complex solutions; and paradoxically often resulting in project delays, and subsequently reduced operational performance.

As the oil price collapsed around 2015, many of the same oil companies performed a U-turn, seeking smaller, simpler projects presenting less risk. More elegant, simpler designs were sought and implemented. As one oil company exec said – “an LNG plant is basically a series of big fridges – how have we allowed them to become so complex that they cost $20bn”?

This is a classic example of one criterion – time – being allowed to excessively outweigh all other criteria, with drastic consequences.

It is also a classic example of where a whole industry comes to believe in a new paradigm, where alternative views are not considered.

2. The Sustainability of your project is judged based solely on Scope 1 & 2 Carbon Emissions

The World GBC Net Zero Carbon Buildings Commitment challenges companies, cities, states and regions to reach net zero building emissions in their portfolios by 2030. From 2021, this was updated to incorporate not only ongoing, operational emissions, but also embedded emissions in built assets, for example in concrete and steel.

As a result, it is fast becoming standard practice to model the total carbon emissions resulting from the whole life cycle of planned capital projects, with a view to minimizing emissions. Inevitably, this leads to affordability challenges often resulting in compromises.

A key issue is that most organizations currently focus on Scope 1 & 2 emissions; i.e. the emissions from directly controlled assets (e.g. gas burners) and indirect emissions released from the energy purchased from a utility provider. However, for many organisations, a far larger source of emissions arises from scope 3 emissions; those that occur within the value chain, both upstream and downstream (e.g. transport of materials and products).

Key decisions such as the selection of the location for a manufacturing plant can have a major impact on scope 3 emissions – proximity to raw materials and to customers will impact on transport emissions.

Many projects may appear to be poor investment decisions in 5 years when viewed through a holistic scope 1, 2 and 3 lens.

Sustainability is not just about Carbon

Of course, sustainability also embraces a wider view of the impact of our projects, assets and operations on the environment. Organizations are increasingly adopting policies focused on “People, planet, & profit” or “Social, Human, Economic, and Environmental” factors.

This results in challenges to understand the optimal balance between many different environmental factors ; for example :

- Balancing carbon against sustainability levers such as rainwater harvesting vs the energy required to pump and recycle water

- Balancing the reduction of industrial emissions such as Nitrogen Dioxide, particulates, Chlorine against the energy (and resultant carbon emissions) required to remove them.

- Increasing on-site renewable energy through solar farms versus the environmental impact of the land use and impact on local communities.

As sustainability is increasingly seen to be a multi-faceted challenge, projects which are designed based solely on minimization of carbon may fail to meet future sustainability requirements, and hence may become unviable or require major CapEx to meet regulatory requirements and public expectations.

3. Your input cost models are based on an extrapolation of current cost trends

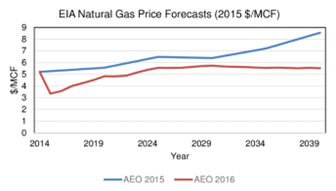

Most projects will build a projection for its commercial viability based on assumptions on the rate of escalation of input costs; e.g. for steel and concrete in the CapEx phase, and for energy, feedstocks, water in the OpEx phase. Typically, these produce graphs like this one for natural gas; based on an annual percentage increase. The limitations of this are immediately shown by how much the 2016 (red) projection has changed from the 2015 (blue) line.

But do these projections bear any resemblance to reality? The second chart shows how gas prices actually played out over 2010-2020. No correlation with either forecast, and a huge variability over time (and of course things got even less predictable in 2022).

The same picture emerges for most input costs; commodity prices do not move according to a formula; they respond in real time to geo-political events, discovery of new reserves, scientific breakthroughs etc.

As such, they are effectively unpredictable. You can almost guarantee that the cost landscape in 5 years’ time will be very different from your forecasts, and could render the capital asset unviable (as currently designed).

So, does this mean we should just give up on forecasts of future return on investment (ROI)? No – but we should abandon false faith in the accuracy of our projections.

Instead, organisations that most effectively assess the viability of their capital projects consider how our ROI would be impacted if each input cost were to vary across a wide range of possible values – much wider than the usual extrapolations. This method of stress testing the viability of the design under various ‘disaster’ scenarios reveals an insightful view of the project, and enables critical design changes to be made at an early stage in order to ensure survivability if the future doesn’t plan out as we might expect.

Examples include:

- Building in the ability to switch from gas to electric heating, or ensuring sufficient space for ground source heating should the economics of energy prices change radically (as we have seen…)

- Ensuring that a chemical manufacturing facility is able to operate on a range of feedstocks rather than being highly optimised for a single raw material.